Content

You can save it as a draft or a final version and either print it or email it. You can create a PDF version of the invoice, copy it, record a payment on it, and set it up to recur on a regular schedule.

What Does Accounting Software for a Small Business Do?

Accounting software reduces the amount of time spent on data entry by allowing users to sync their business bank accounts and credit cards with the software. Once synced, transactions will flow into the accounting software, where they can be categorized into various accounts. While most accounting software is easy to use, a general understanding of accounting principles is needed to ensure that financial reports are prepared correctly. For this reason, many businesses hire bookkeepers or accountants to maintain or review their books. Cloud-based online accounting software makes it convenient for businesses to access their books at the same time as their bookkeeper or accountant.The most basic functions of accounting software for small businesses are:InvoicingBank and credit card syncingAccounts payableAccounts receivableOnline payment collection from customersBasic financial statement preparation, such as profit and loss statements, balance sheets, and statements of cash flowUser… Ещё

Debits and credits should always equal each other so that the books are in balance. Whether you do the bookkeeping yourself or hire someone to do it, certain elements are fundamental to properly maintaining the books.

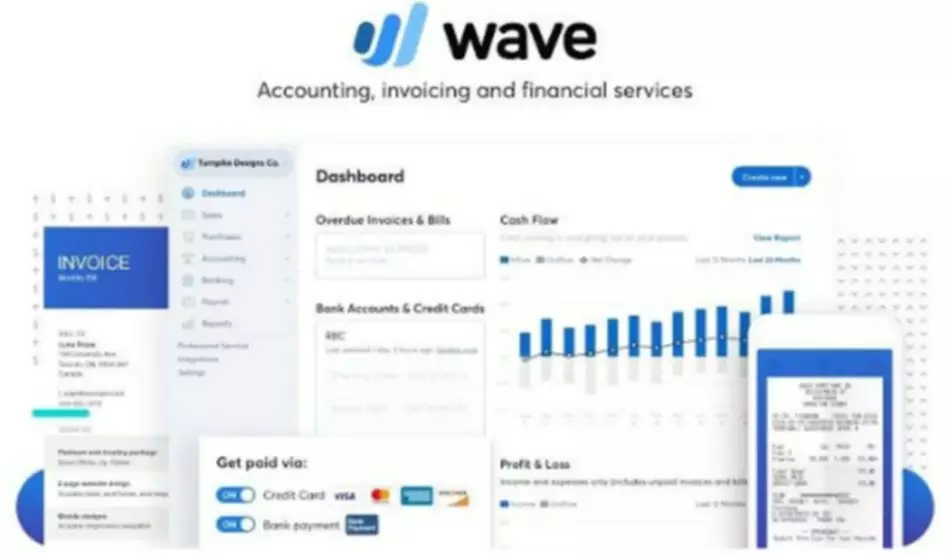

Wave

Very small businesses could use it for basic money management, like sending invoices, monitoring financial accounts, accepting payments, and tracking income and expenses. More complex companies can add advanced tools that include projects and proposals, mileage and time tracking, and reports.

The courses take place entirely online and do not require you to come to campus. Without a set class time you can complete your assignments when it’s most convenient for you while following the course deadlines. Different courses may be available each semester so don’t forget to check back regularly.

Are you ready for tax season?

Bench gives you a dedicated bookkeeper what is business accountinged by a team of knowledgeable small business experts. Get a direct line to your team on desktop or mobile—professional support is just a few swipes, taps, or clicks away. She is a paid member of Red Ventures Education’s freelance review network. Most of your company’s financial knowledge lies with one person, which is risky. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site. We make it easier for you, breaking it down step-by-step, so you can get started today.

When it came time to do accounting software reviews, we focused on options that had solid features that would apply to most businesses, including both small businesses and large enterprises. Companies on a limited budget should still be able to find software that offers intuitive methods for paying bills, invoicing clients, and tracking accounts. A profit and loss statement is a staple accounting tool that summarizes your company’s income and expenses over a given period. All public companies are required to put them out once per quarter. Although small business owners aren’t required to create them by law, P&L statements are great ways to see whether you’re on track to meet your financial goals. The accounting method your business uses will have rules about when and how to document revenue and expenses in your own records and in reports to the IRS. It will affect how you track everything from your balance sheets to your cash flow statements.

Helping small businesses navigate tax season since 2012

Everyone has specific requirements that will differ between users, and knowing you can tailor your software to suit your needs will prove invaluable. It also means you can supplement a basic package as your needs grow over time. All plans include invoice tracking and customization as well as rock-solid security. QuickBooks Online is solid accounting software with several excellent features.

- Together we learn, through events, peer groups and other tools, what the future holds for small business accounting.

- There’s good news for business owners who want to simplify doing their books.

- A good fit for sole proprietors, Sage Business Cloud Accounting makes it easy to track inventory sales and services.

- Therefore, simplicity and value for money are two major factors we also look out for.

- Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

- Subtract interest and taxes from that operating profit, and you’ll know whether your business operated at a profit or a loss that quarter.